Bank of Canada rate hike

Jimmy Jean chief economist and strategist at Desjardins said he thinks the. The Bank has repeatedly stated its commitment to raise rates in 2022.

Canadians With Mortgages Brace For Big Bank Of Canada Rate Hike Business News Castanet Net

The Bank of Canadas aggressive language along with its 75-basis-point boost in the bank rate sends the message that further interest rate hikes are ahead to bring down inflation says Douglas.

:format(webp)/https://www.thestar.com/content/dam/thestar/business/2022/09/06/bank-of-canada-to-hike-interest-rates-by-three-quarters-of-a-percentage-point-experts-predict/bank_canada.jpg)

. The Bank is also continuing its policy of quantitative tightening. See what it isand what it means for you. The OMMFR is an estimate of the collateralized overnight rate compiled at the end of the day by the Bank of Canada through a survey of major participants in the overnight market.

If CIBC economists are correct the Bank of Canadas expected rate hike next week will be its last of this rate-hike cycle. Economists tracked by Bloomberg were expecting a 67 per cent increase. Maturing Government of Canada bonds on the Banks balance sheet will no longer be replaced and as a result.

At the heart of the Bank of Canadas monetary policy is the target for the overnight rate. The Bank is also ending reinvestment and will begin quantitative tightening QT effective April 25. Bank of Canada delivers 075 percentage point rate hike.

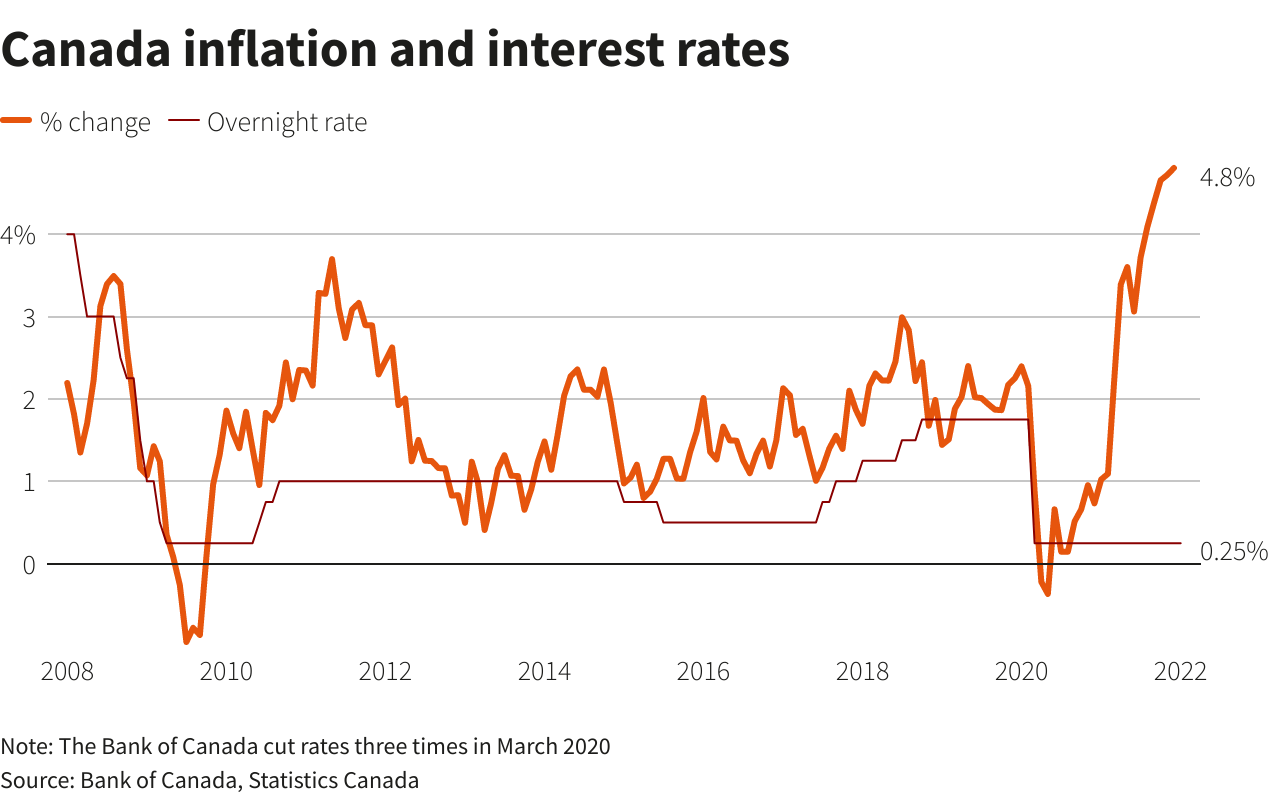

The Bank of Canada today increased its target for the overnight rate to 3¼ with the Bank Rate at 3½ and the deposit rate at 3¼. Economists are expecting the Bank of Canada to continue its aggressive rate hike campaign after inflation data came in higher than expected. The Bank of Canada announced Wednesday that it will increase its benchmark interest rate by a full percentage point taking a larger than expected hike to tame decades-high levels of inflation.

Bank of Canada rate hike September 7 2022. Some of Canadas major banks are forecasting the central bank will raise the key interest rate by three-quarters of a percentage point bringing it to 325 per cent. The Bank of Canada hiked its benchmark overnight rate by 75 basis points to 325 per cent on Wednesday.

Inflation appears to have peaked but its still running hot and a supersized rate hike from the Bank of Canada next week is widely expected. TD and RBC economists expect a 50 basis-point hike on Oct. Growth is expected to slow to about 2 in the third quarter as consumption growth moderates and housing market activity pulls back following unsustainable strength during the pandemic.

There continues to be a consensus that the Bank of Canada will continue hiking rates into October 79 and many think at the December 37 meeting. As of 1 October 2015 Overnight Repos and Overnight Reverse Repos formerly called Special Purchase and Resale Agreements and Sale and Repurchase Agreements are transacted on a. Central banks resolve not to let up in.

In a press release the central bank said The effects of COVID-19 outbreaks ongoing supply disruptions and the war in Ukraine continue to dampen growth and boost prices. Interest rate announcement and Monetary Policy Report. 26 which would bring the Banks policy rate to 375 per cent.

3 minute read October 6 2022 735 PM UTC Last Updated ago Bank of Canadas hawkish message bolsters case for another large rate hike. For every 50 basis-point hike a homeowner with a variable rate mortgage can expect to pay about 28 more a month for every 100000 of mortgage said Victor Tran a mortgage and real estate expect for Ratesdotca. The global and Canadian economies are evolving broadly in line with the Banks July projection.

Interest rate announcement and Monetary Policy Report. The question now on Canadians minds is when will the cycle of rate hikes come to an end. The Bank of Canada is expected to deliver another interest rate increase next Wednesday with forecasters split between a half and three-quarters of a percentage point hike.

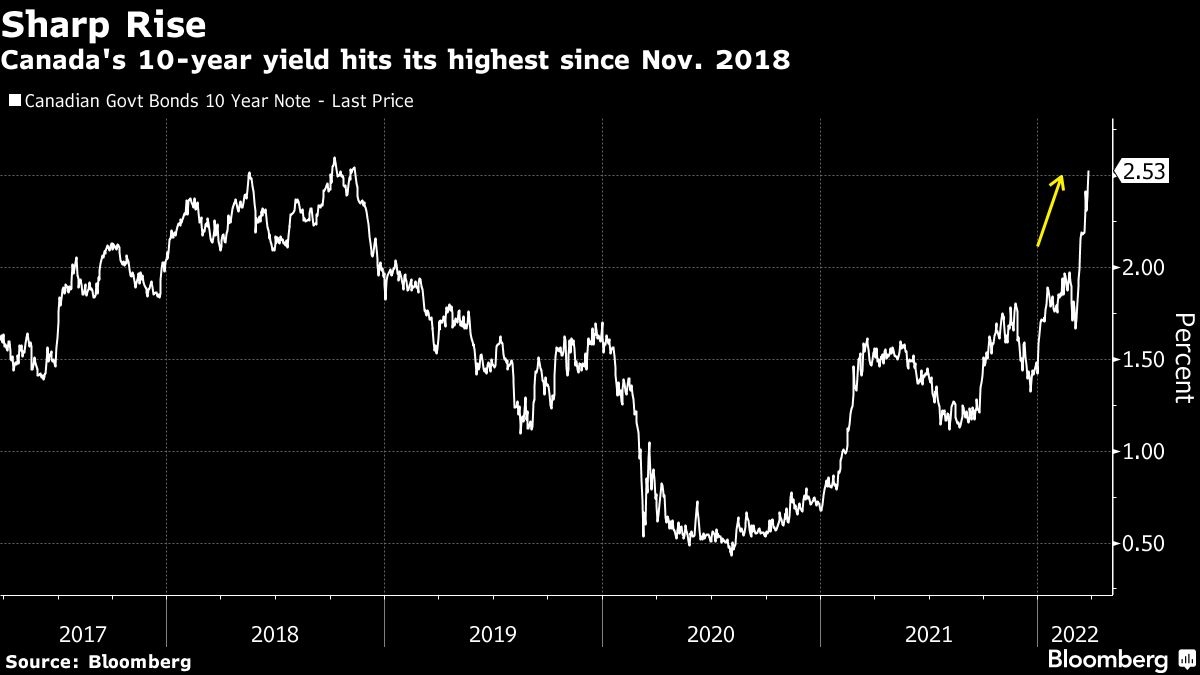

Markets are pricing in a 75-bps hike which would bring the Bank of Canadas overnight rate to 325 just above its 2-3 neutral range and into restrictive territory. The central bank in a regular rate decision hiked its policy rate to 325 from 250 matching analyst forecasts and hitting a level not seen since April 2008. Typically the Bank of Canada rate changes 025 as needed with 05 changes not being uncommon especially during periods of economic instability.

In a report published last week economists Benjamin Tal and Karyne Charbonneau say they expect the Bank of Canada to hike another 75 bps next week and will then call it a day leaving the overnight target rate at 325 for the duration of 2023. The Bank expects Canadas economy to grow by 3½ in 2022 1¾ in 2023 and 2½ in 2024. The Bank of Canada raised its overnight interest rate by 75 basis points to 325 per cent on Wednesday its fifth consecutive hike in its.

The last time the Bank of Canada rate was raised. When the rate went up by one full point on July 13 of 2022 it was one of the biggest jumps ever made. So far in 2022 the Bank of Canada has hiked the policy interest rate a total of five times with the latest increase in early September pushing the rate up by 075 to from 25 to 325.

A history of the key interest rate. All eyes will be on the Bank of Canadas interest rate decision this week which some say could be its last increase of the year and perhaps of this rate cycle. Some economists think Wednesdays hike could be the.

The latest data released by Statistics Canada on Wednesday shows the consumer price index CPI up 69 per cent year-over-year in September. The numbers pave the way for another outsized Bank of Canada rate hike next week perhaps taking the policy rate to 4 per cent the highest since 2008 as more economists are now predicting. The Fed delivered its third straight rate increase of 75 basis points on Wednesday and signaled borrowing costs would keep rising underscoring the US.

The Bank estimates that GDP grew by about 4 in the second quarter. When will the rate-hike cycle end. The Bank of Canada today increased its target for the overnight rate to 1 with the Bank Rate at 1¼ and the deposit rate at 1.

Another interest rate hike from the Bank of Canada means some Canadians could be spending a lot more on their monthly mortgage bills. Some of Canadas major banks are forecasting the central bank will the key interest rate by three-quarters of a percentage point bringing it to 325 per cent. There is generally a consensus amongst economists that more hikes will follow before the end of 2022 but a new report by the Organisation for Economic Co-operation and Development OECD.

The most immediate impact will be for variable rate mortgage.

/https://www.thestar.com/content/dam/thestar/business/2022/08/31/when-will-bank-of-canada-end-its-rate-hikes-it-depends-on-who-you-ask-/bank_of_canada.jpg)

When Will Bank Of Canada End Its Rate Hikes It S Complicated The Star

Bank Of Canada Not Backing Down On Rate Hikes Ctv News

Rate Hikes When Will They End And What Happens Next

The Bank Of Canada S September Rate Hike Will Be Its Last Cibc Mortgage Rates Mortgage Broker News In Canada

Bank Of Canada Signals Hikes Coming Soon Leaves Key Interest Rate Unchanged Reuters

Bank Of Canada Will End Its Rate Hike Cycle At September Meeting Cibc Strategist R Torontorealestate

Bank Of Canada Preview A 100 Basis Point Rate Hike Cannot Be Ruled Out Quebec News

Canada Sees Highest Interest Rate Hike In Decade Amid Inflation Daily Sabah

:format(webp)/https://www.thestar.com/content/dam/thestar/business/2022/09/06/bank-of-canada-to-hike-interest-rates-by-three-quarters-of-a-percentage-point-experts-predict/bank_canada.jpg)

Bank Of Canada To Hike Interest Rates Wednesday By Three Quarters Of A Percentage Point Experts Predict The Star

Bank Of Canada Announces Huge Rate Hike Canadian Mortgage Professional

Bank Of Canada Preview 50bps Rate Hike Fully Priced In Mortgage Rates Mortgage Broker News In Canada

What The Bank Of Canada Rate Hike Means To Homebuyers Youtube

Bank Of Canada Hikes Interest Rates Another 50 Bps And Isn T Done Yet

Hawkish Bank Of Canada Speech Puts Half Point Rate Hike In Play Bnn Bloomberg

The Bank Of Canada S Interest Rate Hike Could Cause A Recession It S Happened Before Narcity

Ppbiheilzsxb0m

Bank Of Canada Rate Hike September 7 2022 How Does It Affect You Moneygenius